Customer Success Outcomes

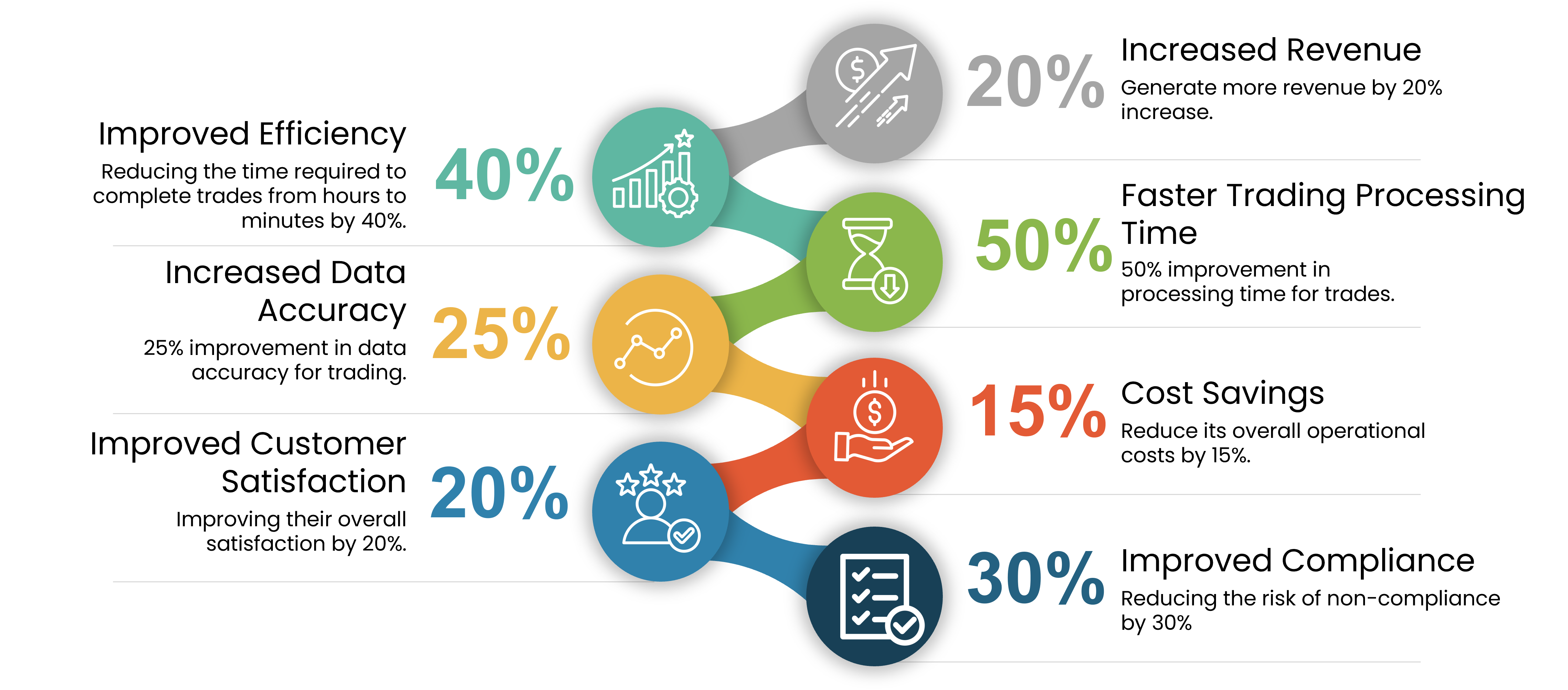

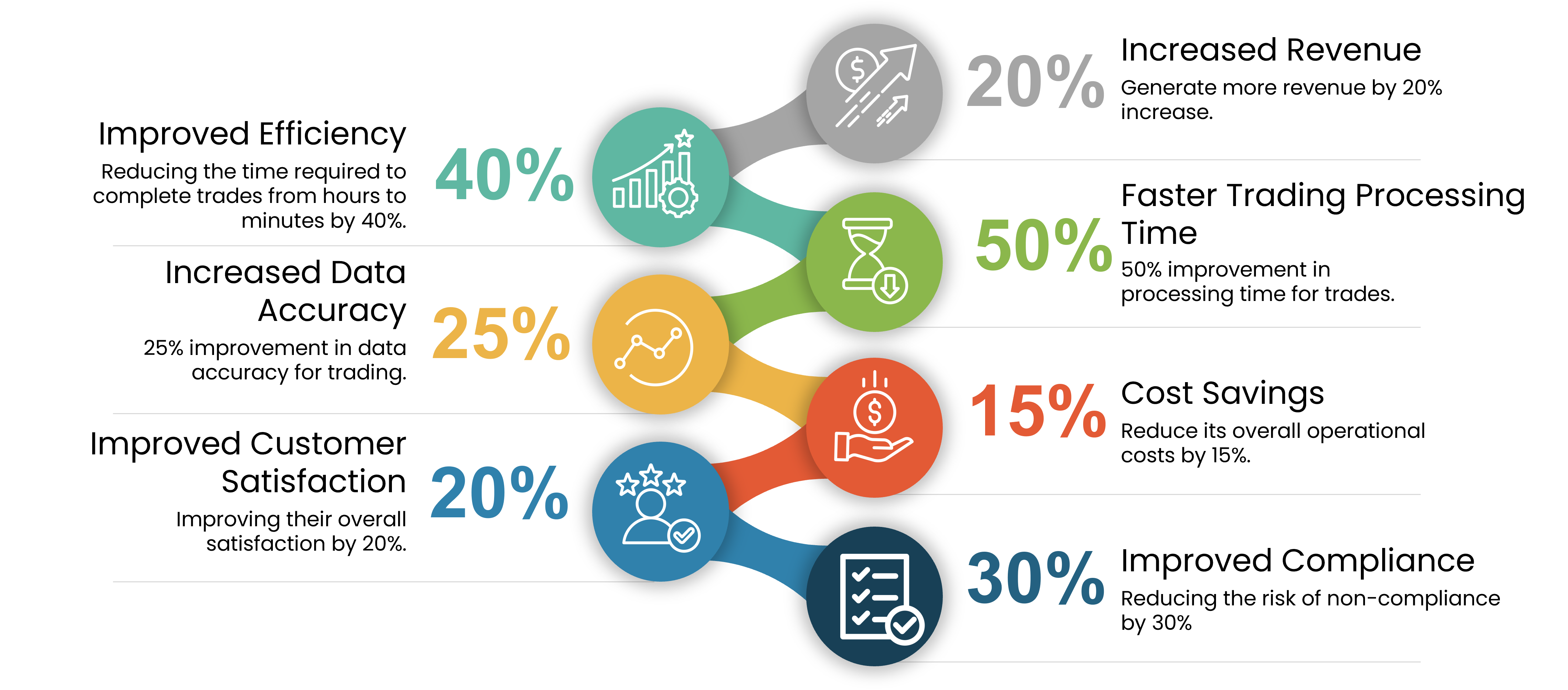

Increased Revenue: By streamlining the trading process and improving the accuracy of data, the integrated trading system helped the financial services company to generate more revenue by 20% increase.

Improved Efficiency: The new integrated trading system allowed the company to process trades more quickly, reducing the time required to complete trades from hours to minutes by 40%.

Faster Trading Processing Time: The new system allowed the company to process trades more quickly, reducing the time required to complete trades from hours to minutes by 50% improvement in processing time for trades.

Increased Data Accuracy: The new integrated trading system provided the company with more accurate and reliable data, reducing the likelihood of errors and discrepancies in trading by 25% improvement in data accuracy for trading.

Cost Savings: By integrating its trading systems, the company was able to reduce its overall operational costs by 15%.

Improved Customer Satisfaction: The new integrated trading system allowed the company to provide its customers with faster and more reliable trading services, improving their overall satisfaction by 20%.

Improved Compliance: The new integrated trading system allowed the company to meet regulatory requirements more efficiently and accurately, reducing the risk of non-compliance by 30%

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)