The integration of Blackline Integration, SAP ABAP, SCP, CPI, and Postman has resulted in a number of positive outcomes for the business. One of the main benefits is the significant reduction of human effort and errors in the financial process, which improves the accuracy and speed of the financial close process. This automation has also helped to increase efficiency and reduce the risk of errors in the accounting process.

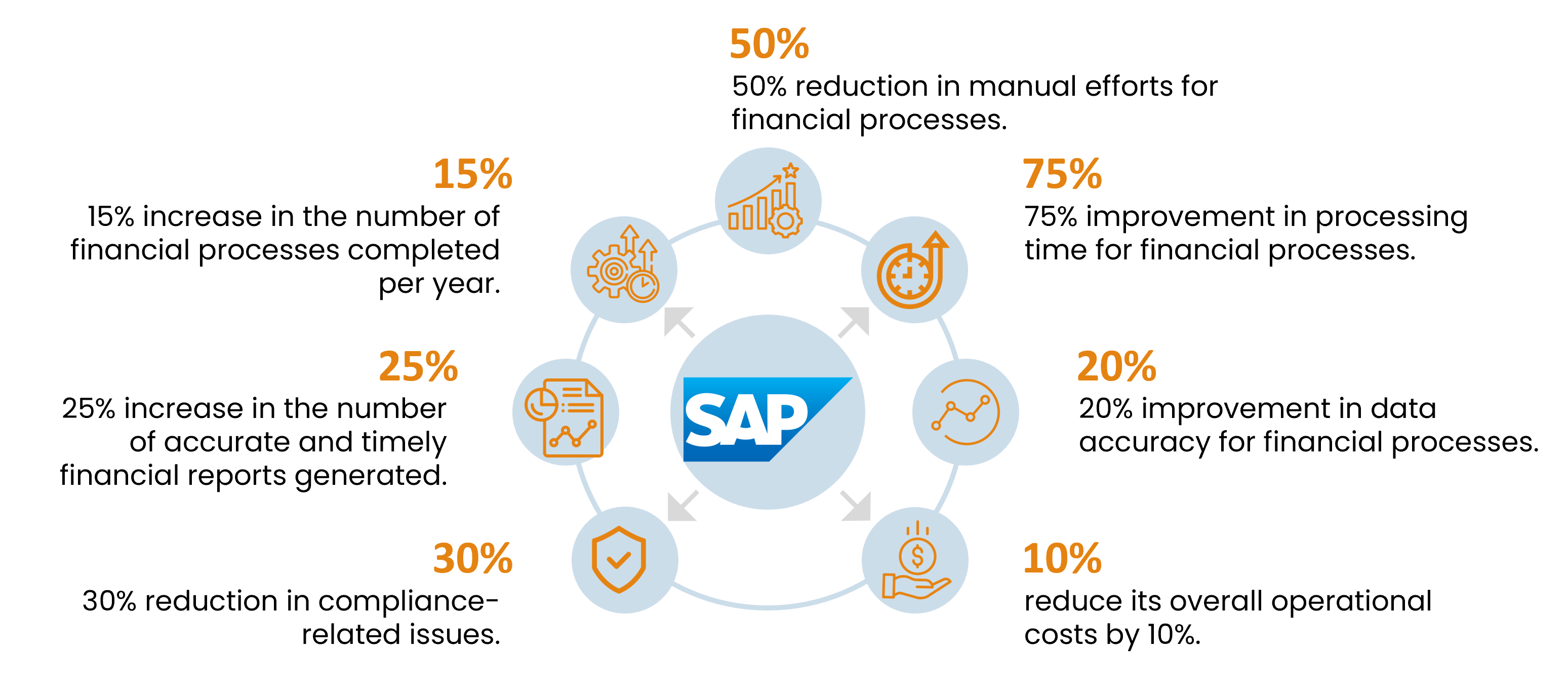

Improved Efficiency: Pronix Inc. helped the medical care company to integrate its SAP and BlackLine systems, which helped to streamline financial processes with 50% reduction in manual efforts for financial processes.

Faster Financial Processing Time: The integrated system allowed the company to process financial data more quickly with 75% improvement in processing time for financial processes.

Increased Data Accuracy: The integrated system provided the company with more accurate and reliable financial data with 20% improvement in data accuracy for financial processes.

Cost Savings: By integrating its SAP and BlackLine systems, the company was able to reduce its overall operational costs by 10%.

Improved Compliance: The integrated system allowed the company to meet regulatory requirements more efficiently and accurately with 30% reduction in compliance-related issues.

Enhanced Reporting: The integrated system allowed the company to generate more accurate and reliable financial reports with 25% increase in the number of accurate and timely financial reports generated.

Increased Productivity: The integrated system allowed the company to complete financial processes more efficiently with15% increase in the number of financial processes completed per year.

Another outcome is the opportunity for business growth and modernization. The integration has allowed the business to move to cloud-based solutions, which provides more flexibility and scalability. Additionally, the integration of different systems such as ERP, CRM, and e-commerce, enables better data flow and more accurate reporting, which can lead to more informed business decisions.

Finally, using Postman to test and document APIs has helped to improve the quality and reliability of the business's APIs, which can lead to better integration with other systems and improved user experience. Overall, the integration has helped the business to streamline its financial process and improve its overall performance.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)